Illinois Owning a home Money

Posts

The fresh Gold were only available in 2019 by Kirill Bensenoff and you can Alex Shvayetsky. They offer multiple individual currency lending products such boost and you can flip, rental, crushed up-and unsecured loans. Lima One to Funding is based inside the Greenville, Sc and you may founded by former Marines.

Multi-Family Money

Joshua Holt are an authorized mortgage creator (NMLS # ) and maker from Biglaw Buyer. His financial solutions is based on the areas of top-notch mortgages, particularly for lawyers, medical professionals or any other high-earnings advantages. Ahead of Biglaw Trader, Josh practiced private security mergers & order laws for starters of the prominent law offices regarding the country. Simple Path Investment’s EasyFix mortgage program will bring boost and you will flip financing to possess people to purchase homes. Our very own rental funding money is actually flexible and versatile, providing you the brand new influence you want plus the reputable money you need. All of our flexible FixNFlip financing explain the new approval process and invite you to move quickly, maximize your influence, and you can pivot when needed.

- It means they could offer a lot more customized mortgage words in order to meet the new borrower’s unique requires.

- Once you have a summary of potential loan providers, take time to contrast the terms, interest rates, and you can charge to make certain you’ll receive a knowledgeable package you are able to.

- Find the energy away from individual lending to own Illinois a property assets having Lima You to Investment.

- Since the its the start in 2011, Lima One Money provides financed over $9 billion in the fund the real deal property traders who are building, boosting, and you will stabilizing areas across the nation.

Enhance And you will Flip Fund

The brand new current experience is not the first time that money provides fallen out of a moving vehicle recently. Nonetheless it registered to hand the brand new keys to Busey instead of you will need to refinance the structure inside a shorter amicable interest ecosystem compared to the if this borrowed. Clear Height, which has over 100 industrial and industrial functions on the Midwest, obtained the brand new Oak Brook office building to possess $13 million inside 2018 within a m&a with individual Ryan Corcoran. The price is a bargain at that time, since the property fetched over $20 million in the 2001, DuPage State info let you know. Panko’s purchase is funded that have a great $10.5 million loan from Lakeside Lender, public records tell you. It could lead to the introduction away from retail to the a share of the property when he considers redeveloping a piece one’s highly apparent, considering a press release.

Chicago and you can Arizona, D.C., Certainly Towns Perfect for Workplace-to-Co-Way of life Sales

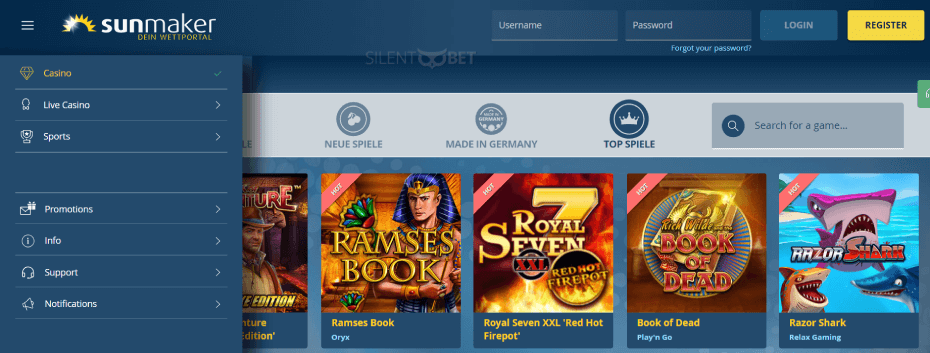

The new MGM subsidiary brings casinolead.ca Recommended Site individuals online casino games which have ports and on line dining table video game from the world’s best software developers. Real-currency casinos on the internet give you the community’s better gambling games so you can qualified people inside legal states. Best real money casinos is common brands for example BetMGM, the brand new Caesars Palace On-line casino, DraftKings, and FanDuel. The scale and you can development of the newest Chicago rental property business is actually promising to have buyers.

They give short term improve and you will flip fund and you will money spent fund. Closing as quickly as 5 business days, at the mercy of clear label. Private credit money devoted to individuals mortgage types, and connection financing, develop and flip fund, ground-right up money, and you may refinance money.As we try advantage-based … NuWay Financial is actually individual loan provider situated in Chicago, IL. They give short term connection money, refinancing, and you can temporary boost and you can flip financing. Clarence discovers a property regarding the Lake Northern subdivision from Chicago, IL in order to redesign and you may resell.

If you are considering a difficult money mortgage in the Chicago, it is important to do your research and get an established bank. The easiest way to discover an established tough loan provider would be to require suggestions off their a home people on your network. You can even do some searching online to possess hard money lenders inside the Chicago and study reviews from past members. A difficult currency mortgage can offer individuals lots of pros. That includes delivering use of the fresh investment they need when other loan providers might have became them down. These fund normally are available easily, too, and therefore individuals might be able to pick a home within the a short length of time.

Nether I, nor any one of my family will have had currency to own a trip in this way when they where inside the university. When he returned he become college or university in the Columbia School in the New york. It is at this time the guy wishes individuals to mention your Barack — perhaps not Barry. Once Columbia, the guy decided to go to Chicago to function since the a residential area Coordinator to have $several,100000 annually.

Full Illinois Market Style

EquityMax entered the fresh fold, providing an excellent “no assessment” solution to guarantee the small closing the newest debtor try asking for. From the EquityMax, we think inside that have our very own clients speak myself to the bosses. We’re a family had-and-operate financial your fund. The owners of one’s company would be the concluding decision manufacturers and you will are happy to talk personally with you about your kind of funding means on each and every real estate investment enterprise.

As opposed to traditional loans or credit unions, tough money finance are usually provided with personal people otherwise organizations. These fund are safeguarded by the a house and are usually made use of by individuals who may not qualify for old-fashioned money due to issues for example less than perfect credit or strange assets versions. Hard currency fund routinely have high interest rates and you may shorter installment terminology versus antique fund, but they also provide quick access so you can investment the real deal estate investments or other monetary needs. Total, tough currency financing is a very important money for real house traders and you can investment property owners in the Chicago who are in need of quick access to help you funding and you will appreciate the flexibleness of tough money finance. When compared with old-fashioned banking institutions, difficult currency loan providers offer a good speedier app processes, quicker strict requirements, and you will economic possibilities designed to your requires out of regional investors. Difficult currency lenders Chicago provide a new solution to home traders and you can homeowners seeking take advantage of funding possibilities.